The possible exit of the United Kingdom (UK) from the European Union (EU), or “Brexit” as it’s come to be known, presents uncertainties for all UK-based organizations, starting with the fact that no one knows what the precise terms of Brexit will be—or even if it’s actually going to happen.

If only we had a crystal ball.

But not knowing what lays ahead doesn’t preclude planning ahead. In fact, for UK-based financial services organizations, particularly those providing services in the EU, the existence of multiple possible outcomes might actually be viewed as an opportunity to re-examine current business models to come up with innovative strategies to make the most of whatever the actual outcome turns out to be.

Here at Exela, in connection with providing continued seamless service to our UK-based financial services customers no matter what the outcome, we’ve been contemplating the following factors, which we’re happy to share:

The power of the pivot

In 2016, the British electorate voted that the UK should exit from the EU. Soon after, Prime Minister Theresa May announced the exit process would begin no later than the first quarter of 2017. However, the PM’s announcement was met with immediate opposition, leading to an extension of the exit date to March 29, 2019. Shortly before that date arrived, the date was extended twice more to account for political disagreement over exactly how Brexit would happen:

- Would it be precisely as it had been envisioned by PM May?

- Or was there room for compromise (also known as “Soft Brexit”)?

- Or perhaps agreement required going even further than May had envisioned in severing ties with the EU (“Hard Brexit”)?

The current date set for Brexit is October 31, 2019. However, in mid-May, Brexit discussions broke down, leading PM May’s resignation announcement. Will the date slip further? Will Brexit happen? If so, how?

Only one thing seems clear at this moment, which is that if and when Brexit is finalized, it will be on short notice (no more than three months, and possibly quite a bit less). Accordingly, being prepared requires “planned agility” with the ability to pivot easily and seamlessly. To cultivate such agility, it’s not a bad idea to consider assembling a Brexit leadership team that meets and reports to the CEO on a regular basis (e.g., weekly, or perhaps often as the calendar draws closer to the current Brexit date). Such team would ideally be comprised of key stakeholders.

The relocation equation

One of the major challenges for UK-based financial organizations is that Brexit may mean an end to the current “passporting system,” which enables all EU firms to trade freely with one another, with minimal authorization. If that’s the case, then UK-based financial organizations will suddenly be subject to an array of newly applicable regulatory requirements…unless they relocate, in whole or in part, to a location within the EU.

The “relocation equation” is a complicated moving target, factoring in, among other things:

- How much of the business is affected by newly applicable regulatory requirements?

- Is it possible to relocate some but not all of the business?

- What are the costs associated with relocation (including loss of human capital, time needed for new recruiting, etc.)?

- What is the availability of appropriate premises in alternate locations?

Workforce impact

In the event of Brexit, the following considerations may come into play and should be taken into account at the planning level now:

- Whether and which employees have EU passports

- Willingness of non-EU-passport-holding employees to register as EU citizens

- Workforce sentiment regarding relocation.

- New qualifications, trainings, and certifications that relocation necessitates.

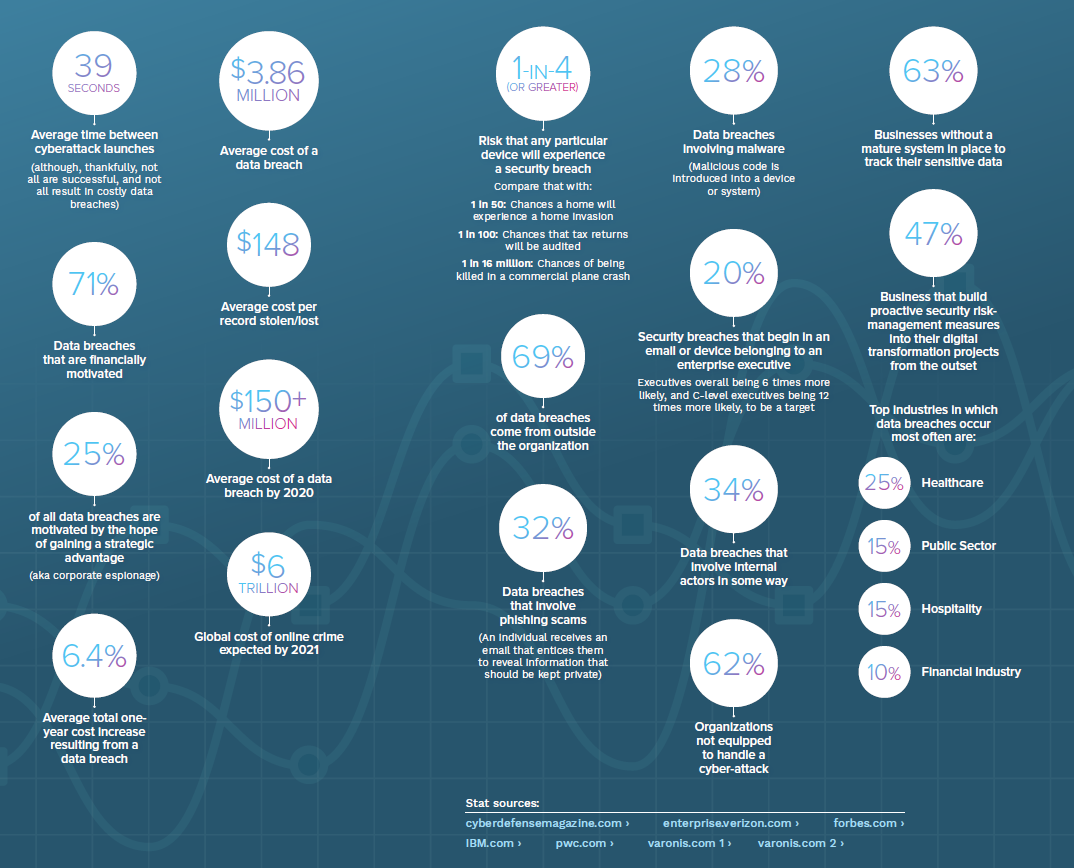

Data security

Currently, data security is governed by the EU’s General Data Protection Regulations (GDPR). The UK has committed to adopting an equivalent set of regulations in the event of Brexit, as well as a fail-safe sort of provisions acknowledging that companies in compliance under the EU are presumptively in compliance with the UK equivalent. But while this allows for the continued flow of personal data from the UK to the EU, it doesn’t take into account the flow of data from the EU to the UK, with respect to which new regulations are anticipated, along with new reporting requirements.

***

Although it’s impossible to predict exactly how Brexit will unfold, strategic planning must continue for financial services organisations, particularly those based in the UK and performing services throughout the EU. The absence of a clear end-game does not preclude strategic planning, but rather requires the consideration of a variety of factors, some of which we’ve identified here, and all of which Exela, as a provider of services to financial services organizations throughout the world, is taking into account in its own contingency planning.

You can learn more about here about how Exela’s Banking & Financial Services Suite of solutions can streamline your financial institution’s compliance processes—from time-consuming, labor-intensive, and error-prone to time-saving, efficient, and cost-saving. Embracing complexity, delivering simplicity. It’s what we do at Exela.