What’s the Big Deal with Real-time Payments?

For approximately 5,000 years, physical notes and coins have served as a reliable medium of exchange, enabling commerce to take place with relative ease due to their widespread acceptance and trustworthiness. In modern times, the older financial instruments, such as checks and promissory notes hindered the settlement process, as clearing often took significant time.

However, in the digital age, such payments moved to online platforms. They expanded further, minimizing the friction associated with physical financial transactions, expanding geographic access, and more with the emergence of mainframe computers revolutionizing electronic payments.

With the rise of e-commerce and digital transactions, online payments have become integral to modern business transactions, providing convenience, speed, and security to customers and businesses alike.

Online and real-time payments enable customers to purchase from anywhere and anytime, allowing businesses to reach a global audience. In addition, online transactions provide a streamlined payment process, eliminating the need for physical cash and checks.

Understanding Real-time Payments

Real-time payment (RTP) (also known as “immediate payment” or “instant payment” due to its speedy nature) refers to an account-to-account funds transfer. It enables immediate availability of funds for the recipient and instant transfer for the sender. With real-time payments, the balance is confirmed in real time, and the payer's account is debited instantaneously upon authorization of the payment. Although settlement timing may vary across systems, it typically takes only a few seconds to complete. Real-time payments are also known as immediate payments or instant payments due to their speedy nature.

It's worth noting that real-time payments are irrevocable, which means that once the payment is initiated, the payer cannot cancel the transfer. In the past, early RTP systems were limited by nightly, weekend, and holiday restrictions. However, the latest versions offer round-the-clock access, every day of the year.

Benefits of Real-time Payments Over Traditional Payment Methods

- First and foremost, they enable immediate availability of funds to the recipient, eliminating the need to wait for payment clearing or settlement. This feature is particularly useful for time-sensitive transactions, such as bill payments or emergency transfers.

- Real-time payments also provide a high level of payment certainty, as the payer's account is debited instantly upon authorization of the payment. This reduces the risk of fraud or non-payment, as the payer cannot cancel the transaction once it has been initiated.

- Furthermore, real-time payments offer increased convenience and flexibility for both consumers and businesses, enabling transactions to take place at any time and from any location. This can result in improved cash flow for businesses and increased customer satisfaction.

- Finally, real-time payments can lower transaction costs, as they are often more efficient and streamlined than traditional payment methods. This can result in cost savings for businesses and increased financial inclusion for consumers who may not have access to traditional banking services.

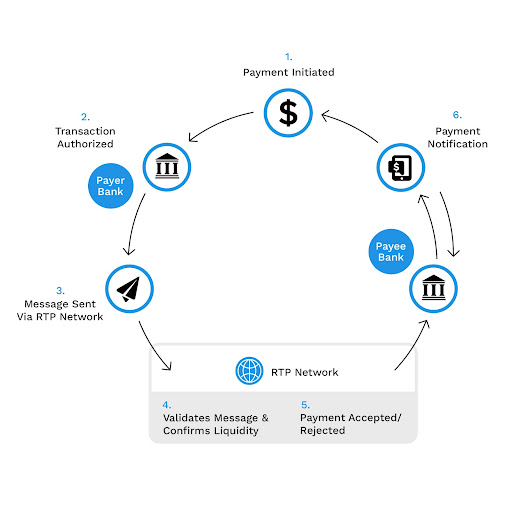

How Does Real-time Payment Work?

Real-time payment enables near-instantaneous transfer of funds between accounts, with the recipient receiving the payment immediately upon authorization. The exact process for real-time payments can vary depending on the payment system being used, but the following steps provide a general overview:

- The payer initiates the payment using a payment system or app, which connects to their bank account or credit/debit card.

- The payment system verifies the payer's identity and funds availability before authorizing the payment.

- The payment is transmitted to the recipient's bank or payment system in real time.

- The recipient's bank or payment system verifies the recipient's identity and account details before crediting the payment to their account.

- The payer's account is debited instantly upon authorization of the payment.

- The payment system or bank provides confirmation of the payment to both the payer and the recipient.

Real-time payments are typically processed within seconds, offering a fast and secure way to transfer funds between accounts. To ensure the safety and security of online transactions, various measures such as encryption, authentication, and fraud prevention are employed to protect both customers and businesses during these transactions.

Real-time payments are changing the world by revolutionizing the way we exchange money and conduct financial transactions. Get in touch to learn more.